How Much Can You Write a Check Over for at Walmart

Jim is a bank teller who has witnessed many check-writing mistakes and is here to advise you on how to avoid them in the future.

As a bank teller, I am exposed to quite a number of customer errors regarding their checks. These errors can cause all sorts of trouble for everyone involved. Although some tellers take the liberty of correcting certain mistakes, officially, they aren't allowed to modify checks.

Take a moment to carefully examine all banking documents—the financial institution will appreciate it.

Below is a list of the most frequent mistakes (in no particular order):

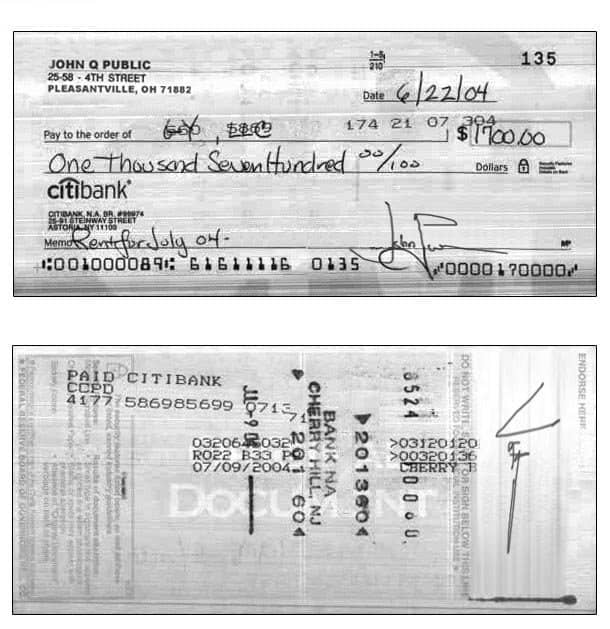

1. The written amount doesn't match the numeric amount.

For instance, a person may complete a check with the written amount as one hundred dollars, but the numeric amount is only $10.00. Almost daily, we return checks for this reason. In cases like this, the bank has the option of accepting the check for only the written amount, contacting the customer to authorize a change, or returning the check.

2. It's not dated, or the date is incorrect.

Some customers simply neglect to date their checks. Others supply the wrong date (post- or stale-dated) both intentionally and unintentionally. When postdating your check, make an effort to inform the payee of it. Checks with no date, future dates, or those dated a certain number of days in the past will be returned.

3. The check is not signed.

Surprisingly enough, many people will complete every other portion of their check and then forget to sign it. These are returned instantly.

4. The signature doesn't match the one on file.

As we age, our signature changes. Other events can also alter the way a person signs documents. If the signature on a check differs noticeably from the initial sample provided, it will be returned. The best way to remedy this is to furnish a more recent sample of the signature.

5. The check is modified or altered.

Checks that appear to have been altered with scratch-outs, write-overs, different-colored inks, or multiple handwriting styles are considered altered. Even if the cause is a simple mistake, these changes look suspicious and may cause the check to be returned.

If a mistake absolutely must be corrected, use one line to cross out the error, and initial the changes. This may not guarantee that the check remains valid, but it will lower the level of suspicion. Never use whiteout on or photocopy any checking documents.

To reiterate, closely examine checks and other banking documents before submitting them. Items are much more likely to be processed quickly if they have been completed correctly.

This article is accurate and true to the best of the author's knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

Theresa Mire on January 30, 2019:

I got a check and the word valid is written on it can i still cash it.

Steve on November 03, 2018:

A customer sent me a check with the amount filled in in number, but did not write out the amount in words. Can I just write in the amount in words myself and deposit the check?

Jay on July 13, 2018:

I sign back of check on first line but dont have n account with chase and it is made out to cash. Can i still sign it over to friend to cash

David on July 09, 2018:

Read More From Toughnickel

can i cash a check i signed even if my dad wrote on the back of it where it says "do not write below this line"

Surya on June 25, 2018:

I used' and ' word two times while writing amount in wordings may I know whether it will get clear or not

Anthony Lomelino on May 30, 2018:

Check was declined code 404 popped up

Jay on March 29, 2018:

If you write a check to the courts and do not write out in words the amount is the check still good? The amount is there in the box with the numbers but you forgot to write out the words of amount. Check still good?

Tammy Parker on March 24, 2018:

My fiancee had me deposit two t-checks. He spelled out the issuing co name as C. H. Robertson, it should have been C. H. Robinson. Authorization went through everything match. Bank deposited but put 4 day hold on it. Will it clear? Was honest mistake.

Jimmy on February 19, 2018:

Am untrain teller,I recently pay out a check that it's words and figure differ. I later discover and called back the customer and the cash retrieved. On the process of retrieval management were informed. What should I do for management took it that it's stealing on my part?

Johnny on December 17, 2017:

I Only Wrote My Name In The Wrong Place In Where My Employer Is Supposed To Sign , How Big Of A Problem Will This Give Me & What's The Best Next Step

?

NickRoark on December 16, 2017:

I took my check to Chase and they put their Stamp on it but said they couldn't cash it cause I didnt have an account with them now nowhere else will cash it what can I do???

Kowshika on December 07, 2017:

I posted wrong month in my cheque. If it come back to me or the bank. Answer me soon please

Kowshika on December 07, 2017:

If the month is wrong means will it returns to me?

patricia on September 20, 2017:

I received my daughter's financial aid check however, because I thought it was her financial aid I had her sign the back of the check we bought didn't pay attention to who the check was written for. I put a line through her name and initialed it then I signed my name. Will the check be returned?

Brian on June 23, 2017:

I just received a cheque from a big company it is a computer written cheque but there was a mistake in the address is the cheque still good.

NANDHINI on June 13, 2017:

In case forty is spelled as fourty in cheque means will it get return???

Answer me asap

Kenneth on June 13, 2017:

I went to cash a check with a bank and because I didn't have an account they wouldn't cash it so they put whiteout tape on the back of it and now when I went to another place to cash it they said they wouldn't cash it because of that what do I do

royalnesh@gmail.com on April 13, 2017:

Hi. I received a cheque from a competition in College. The amount has a crossed '3' then written '5' and signed.

The cheque has 2 signatures and one of the signatures has been resigned just side by the corrected digit for approval of the correction.

Is the cheque valid? do I need both the signatures for the correction to be valid?

Nathan osei on January 13, 2017:

I have a check from my dad which am supposed to use that money for my school fees and wanted to pay it through my bank card but it only said the school initials on the Oder of: and on the memo it says my name but can l cancell the school initials and put my name there cause that is what my bank is looking for before they can assept the check

margie on September 18, 2016:

i have a wrong spelling like instead of fils i wrote it "Fills" is this acceptable?

Ck on August 03, 2016:

How can i resolve my problem , i wrote 40,000 in words as fourty instead of forty. Can bank accept it or not ?

And also the other check. Is 25,000 which is i wrote twenty thousand then i forgot to write five so i put it upper between the space of twenty and thousand. ? Is it okay ?

junior on March 25, 2016:

I got 88 hrs of vacation time and cashed in 40 hrs of my vacation and on my check they took out $680.00 which is 40 hrs of my vacation and they also took 40 hrs away from my vacation which leaves me 48 hrs left. I was like what the f#$#. I got my check stubs to make this rite on Monday. Steelhead metal corp.

jeniffer on November 21, 2015:

I have my own buisniss and tryed making out payrolll checks my self to save time and money.i screwed up acouple.then scratched name off paper to redew them paper looks fuzzy.is ther any way i can fix that .or do i just retyp over them .im out of paper

nilam on July 25, 2014:

Only scratch littlebit in my paycheck on my name is it approve by bank?

nilam on July 25, 2014:

My check is in laundry machine it is little bit scratch is bank can accept?

Johnb876 on July 22, 2014:

Write more, that's all I have to say. Literally, it seems as though you relied on the video to make your point. You obviously know what you're talking about, why throw away your intelligence on just posting videos to your site when you could be giving us something enlightening to read? bfbddddabdgd

Sunil on August 18, 2012:

date on my check was give an --/--/200--.but i have issued it by changing the year as 2012,will this check be valid?

please answer as soon as possible.

monicamelendez from Salt Lake City on July 17, 2012:

I recently wrote the wrong amount when I wrote it out. Not to worry, it was only $600 off. Hahhaha oops!

jennifer on June 21, 2012:

what if you put the amount where the "pay to" line was? can i still write the check?

wrong on June 02, 2012:

Dates on checks are irrelevant. Post dating makes no difference. There doesn't even have to be any date on a check for a bank to process it.

ajb on June 09, 2011:

I wrote a check for one thousand and four pounds 80 pence

but accidently put £10004.80 and they paid out the £10004.80 how do I resolve this I have notified my bank manager he is not that confident on my behalf

jimbody (author) from Chicago, IL on June 24, 2010:

Yes, check kiting, identity theft and forgery continue to be big issues in the banking industry. My job as a teller requires me to examine documents very closely and verify identities as mentioned in the hub. Although lots of the processes are automated now, every paper item that goes through today's banks has a digital picture taken of it, front and back. Those images are reviewed not only by the branch staff, but proof corrections, bookkeeping and other departments as well. If anything, checks are under more scrutiny now than they were in the past mainly because it's easier for bank employees to review them digitally.

For instance, before the advent of computerized banking software, signatures could only be verified by retrieving the paper sample from a filing cabinet. Now those samples are a few keystrokes away and much more accessible.

Hope this helps, and thanks for the feedback! :)

Chip from Cold Mountain on June 24, 2010:

Surely you saw the movie, "Catch Me If You Can". Are the security items brought up in that movie still relevant today?

And, do banks really continue to check the checks as closely as you talk about? I thought processing checks was mostly automated now.

Thanks for a timely article.

jimbody (author) from Chicago, IL on June 24, 2010:

Good point. This hub applies to the United States. Cheers! :)

CASE1WORKER from UNITED KINGDOM on June 24, 2010:

In the United Kingdom they will be stopping cheques soon but I don't know what they have thought of for those times when only a cheque will do

How Much Can You Write a Check Over for at Walmart

Source: https://toughnickel.com/personal-finance/Top-Ten-Most-Common-Check-Writing-Mistakes

Belum ada Komentar untuk "How Much Can You Write a Check Over for at Walmart"

Posting Komentar